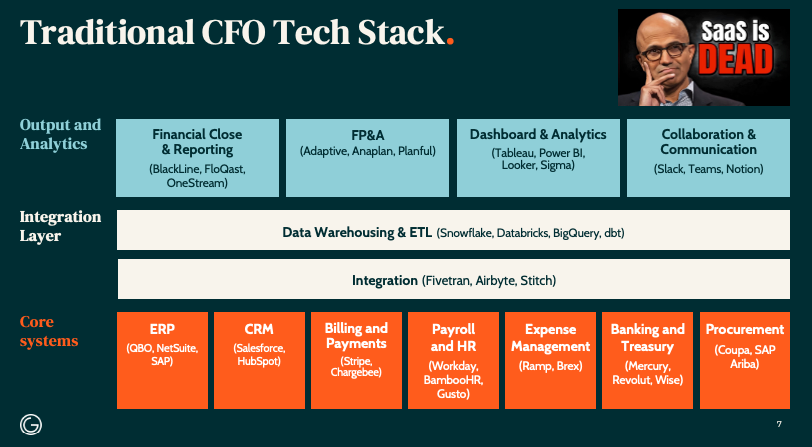

The traditional CFO tech stack is siloed and inefficient

Core systems (ERP, CRM, billing) feed into integration layers (data warehousing, ETL tools).

Output layers (FP&A tools, dashboards) require manual intervention.

Agentic AI replaces this with a centralized "finance data warehouse" where autonomous agents handle processes like accounts payable/receivable, treasury management, and compliance.

Traditional Stack: Layered architecture requiring human intervention.

Agentic Stack: A unified system with autonomous agents managing end-to-end processes.

Only a small fraction of CFOs feel their teams are truly prepared to leverage AI.

Deloitte says fewer than 20% of CFOs say their teams have a clear AI strategy, even though 42% plan to invest significantly in AI this year.

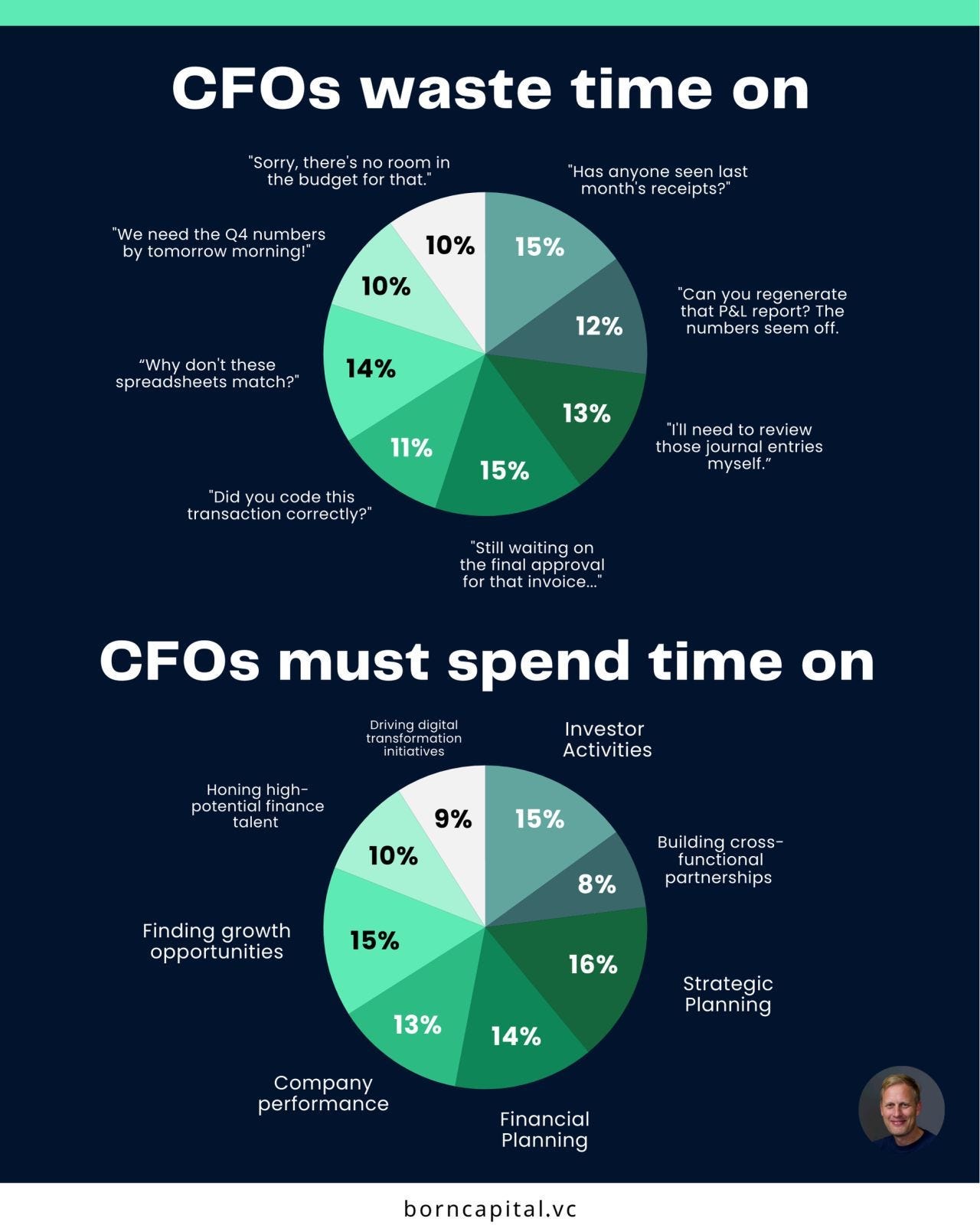

The CFO must stop working like a chief Accounting officer.

And start leading as chief value officer.

How to integrate AI in finance

1. Fix What’s Broken First

Before AI can transform finance, CFOs must modernize their core financial systems. AI amplifies efficiency, but it can’t fix data silos, outdated processes, or broken workflows on its own.

Without a solid foundation, AI projects will fail.

Start With the Basics

Many finance teams still rely on legacy ERPs, scattered Excel models, and disconnected systems. This leads to:

Slow, manual financial close? AI can cut processing time in half.

Outdated forecasts? AI adjusts predictions instantly based on live data.

Compliance risks? AI spots anomalies before they become fraud.

AI can’t function without structured, real-time data. Before implementing AI, CFOs must:

Break down data silos. Unify financial data across ERPs, FP&A, and reporting systems.

Invest in a modern finance tech stack. Move beyond legacy systems to cloud-based platforms.

Automate core financial processes. Standardize workflows to reduce errors and improve speed.

Do this today

Assess your finance tech stack. Are your ERP, FP&A, and reporting tools fully integrated?

Find gaps. Where are data silos and process inefficiencies slowing you down?

Upgrade strategically. Before introducing AI, ensure your financial systems are modern, automated, and scalable.

CFOs who invest in fixing the fundamentals will see faster, more reliable AI adoption without wasted investments in tools that can’t function in a broken system.

The Pareto Rule applies here; 80% of inefficiencies come from 20% of finance processes.

2. Get CEO and IT Buy-In

AI won’t sell itself.

CFOs must build a clear business case that proves AI’s financial impact.

Without measurable ROI, AI initiatives won’t get leadership support, and without IT integration, they won’t scale.

High-ROI AI Use Cases That Get CEO Approval

CFOs who successfully get AI buy-in focus on profit-driving, efficiency-boosting use cases, such as:

Real-Time Forecasting

Traditional forecasting is lagging and manual. AI models adjust in real time using market conditions, sales trends, and operational data.

Example: Team Car Care (Jiffy Lube franchisee) uses AI to predict customer traffic, optimizing staffing and inventory and cutting waste and lost revenue.

AI-Powered Risk Simulations

AI runs real-time scenario modeling to predict financial risks and their impact.

Example: Mastercard uses AI-driven risk models to predict credit risk, optimizing fraud detection and compliance monitoring.

Automating Financial Close

AI speeds up month-end close by matching transactions, flagging anomalies, and reconciling accounts.

Example: BlackLine cut close cycles by 50% using AI-powered anomaly detection.

These aren’t experimental AI projects.

They drive tangible ROI, making the case for broader AI adoption.

How to Get CEO & IT Buy-In

Translate AI into Revenue & Cost Savings

Show AI’s bottom-line impact. How will it increase margins, reduce errors, or accelerate processes?

Use data from early AI adopters in finance and FP&A to validate ROI.

Make AI an Enterprise-Wide Strategy

AI isn’t just for finance. It affects IT, compliance, and business units.

Ensure AI aligns with broader corporate goals (efficiency, risk reduction, decision-making).

Work with IT & Compliance from Day One

AI requires secure, structured data and must integrate with existing financial systems.

Bring in IT leadership early to ensure AI tools are scalable and compliant.

Pilot AI in a High-Impact Area

Avoid company-wide AI rollouts. Start with one AI initiative with a clear ROI.

Use that success as proof of concept to gain CEO and IT confidence.

3. Lead with Data

AI is only as good as the data it’s fed.

If finance data is messy, outdated, or siloed, AI won’t work. CFOs must clean up their data foundation first; no shortcuts.

Why Finance Data Needs Fixing

Disconnected Systems: ERP, FP&A, and reporting tools often don’t talk to each other, leading to data fragmentation.

Inconsistent Formats: Different teams use different data structures, creating errors and delays.

Poor Data Governance: Lack of controls leads to compliance risks and unreliable AI outputs.

Bad data = bad AI decisions.

How CFOs Can Fix Finance Data

Remove Data Silos

Break down barriers between ERP, FP&A, and reporting.

Create a single source of truth for finance data.

Invest in a Finance Data Lake

Centralize structured & unstructured data so AI can process it.

Store historical financials, transaction records, and operational data in one place.

Example: Companies using data lakes with AI-powered analytics see 30-50% faster reporting cycles.

Stay on Top of Data Governance & Compliance

Define clear data ownership across finance, IT, and compliance.

Automate data validation & anomaly detection to improve accuracy.

AI models trained on inaccurate or biased data will deliver wrong insights. A compliance risk CFOs can’t afford.

Standardize Finance Data Formats

Align data across systems (e.g., same definitions for revenue, costs, and KPIs).

Use AI-powered data mapping to fix inconsistencies.

Integrate Real-Time Data Feeds

AI needs access to live financial data to provide accurate forecasts and decision support.

Remove manual uploads & batch processing. Enable real-time data syncing.

Do this

Audit your finance data. Where are the silos and inconsistencies?

Create a data strategy. Define who owns finance data, how it’s cleaned, and how it’s governed.

Upgrade tech infrastructure. Use a data lake or modern cloud platform for AI readiness.

The Bottom Line

AI Can’t Work Without the Right People

Without the right talent, even the best AI strategy will fail. CFOs must build teams that have the skills, mindset, and structure to leverage AI effectively.

Deloitte says GenAI adoption is now a top 3 internal risk for 48% of CFOs, due to the lack of GenAI talent and execution risks. The next generation of finance leaders must be fluent in AI-driven data analysis, automation, and strategic problem-solving.

The finance function of the future relies on

Data & AI Literacy: CFOs must prioritize finance professionals who can interpret AI models and leverage predictive analytics.

Change Management Skills: AI adoption isn’t just technical. It’s cultural. CFOs need leaders who can drive AI integration across teams.

Cross-Functional Collaboration: AI in finance impacts IT, risk, and operations. CFOs should hire talent that can bridge finance with other departments.

Prepare your finance teams.

A Deloitte survey found that companies with structured AI training programs scale AI initiatives faster than those without. CFOs must:

Launch internal AI training programs.

Rotate employees across data analytics and FP&A teams to build AI competency.

Reward AI Champions in Finance

CFOs must find employees who take initiative in using AI and reward them with:

Promotions

Leadership roles

Expanded responsibilities

Jessica Wijesekera, SVP of Global Accounting at Vytalize Health, promoted her accounts payable manager after they introduced an AI-based payments solution.

Remember:

AI needs experimentation: Rapid iteration and cross-functional collaboration. All of which go against traditional finance habits.

AI is misunderstood: Finance fears job loss instead of seeing AI as a tool to improve their work.

AI without human expertise is dangerous: AI can’t replace human judgment in critical financial decisions. Teams must learn how to work with AI, not against it.

And that's all for today.

The waitlist for finstory.ai is open, and we're inviting early adopters to join as pilot customers!

If you’re interested, sign up for the waitlist here.

Best regards,

Team at finstory

AI-native platform that turns financial data into board-ready stories.

Find us on LinkedIn | finstory.ai

Magnificent article. Forward-thinkers and iterative mindsets are not common among the accountants and corporate finance professionals out there. I like how some of these points sound similar to product management.

I think the newer generation will be ready to fully leverage AI and for us more senior, we can’t forget to constantly refine our skill set.